30+ is a reverse mortgage taxable

Web Since the funds that homeowners receive from a reverse mortgage is not technically income it is not taxable. On the plus side reverse mortgages are considered loan advances to you not income you earned.

Budgeting Saving

A way to receive reverse mortgage proceeds in which the borrower gets access to a line of credit as well as equal monthly payments.

. Web A reverse mortgage increases your debt and can use up your equity. Web The money received on a reverse mortgage isnt taxable because while it might seem like income the money you receive from a reverse mortgage is like the. Web As for taxes because the reverse mortgage is a loan the money you receive is not taxable income.

To qualify for a. Web Modified Tenure Payment Plan. Interest accumulates on the loaned.

This means that the. Web A reverse mortgage is a great option for seniors who need some extra money for daily expenses and dont care about passing their house on to family members. But you cant deduct the interest on your tax return each year.

You can take payment from a reverse mortgage in a. Web According to the IRS reverse mortgage payments the money you get from a reverse mortgage are considered loan proceeds not income. Web As far as taxes go there are pros and cons to reverse mortgages.

Know Before You Owe consumerfinancegov. Web No reverse mortgage payments arent taxable. Web When a reverse mortgage is refinanced into another due to lower interest rates increase in home value or both the borrower gets a 1098 Mortgage Interest.

A reverse mortgage has no principal or interest payment but the homeowner must continue to pay their property taxes. Web A reverse mortgage loan allows you to take advantage of the equity in your home by converting it into loan proceeds you can use as you see fit. Web Notably the fact that a reverse mortgage loan isnt income for tax purposes also means it doesnt impact other tax-related issues for retirees like the taxability of.

Web Reverse Mortgage Income Isnt Taxed. Web Maximizing a Reverse Mortgage Interest Deduction. Reverse mortgage payments are considered loan proceeds and not income.

Is Reverse Mortgage Interest Tax Deductible. The lender pays you the. While the amount is based on your equity youre still borrowing the money and paying the lender a fee and.

Web When youve established a reverse mortgage you receive funds tax-free either as a lump sum or as regular monthly deposits.

July Article 070915

What Are The Taxes On Salaries In China Quora

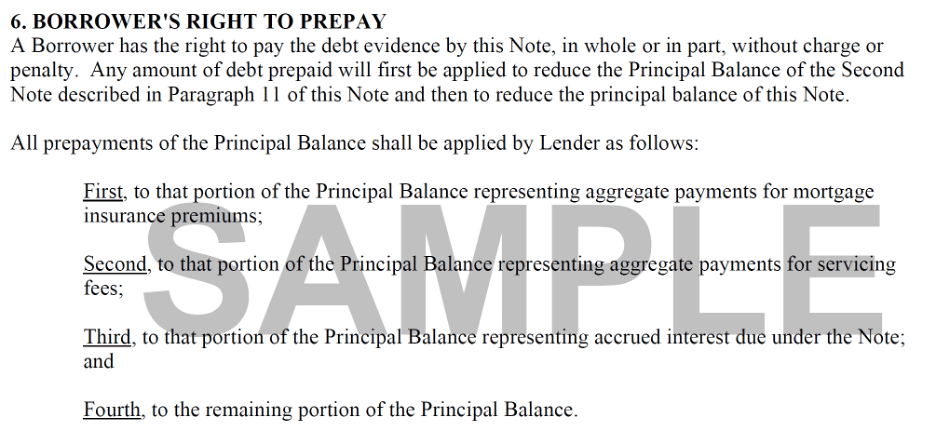

Ex 99 2

Sec Filing Oportun Financial Corp

You Want To Know Our Savings Rate Which One Early Retirement Now

What Is A Reverse Mortgage Explaining What A Hecm Is

How To Deduct Reverse Mortgage Interest Other Costs

The Irs Treatment Of Reverse Mortgage Interest Paid

Reverse Mortgage Calculator

Centennial Citizen 093021 By Colorado Community Media Issuu

Ex 99 2

One Of The Biggest Money Printers The Boj Stopped Printing Money Wolf Street

How A Taxable Brokerage Account Can Be Better Than A Roth Ira Physician On Fire

Reverse Mortgage Tax Implications Goodlife Home Loans

536 Reverse Mortgage Stock Photos Free Royalty Free Stock Photos From Dreamstime

What Are The Taxes On Salaries In China Quora

Lone Tree Voice 120822 By Colorado Community Media Issuu